Nest Wealth Direct

Simplified Wealth Management for individual investors

One of the lowest Portfolio Management fees in Canada

Keep more of your money

Nest Wealth Direct offers sophisticated wealth management that lets you minimize costs.

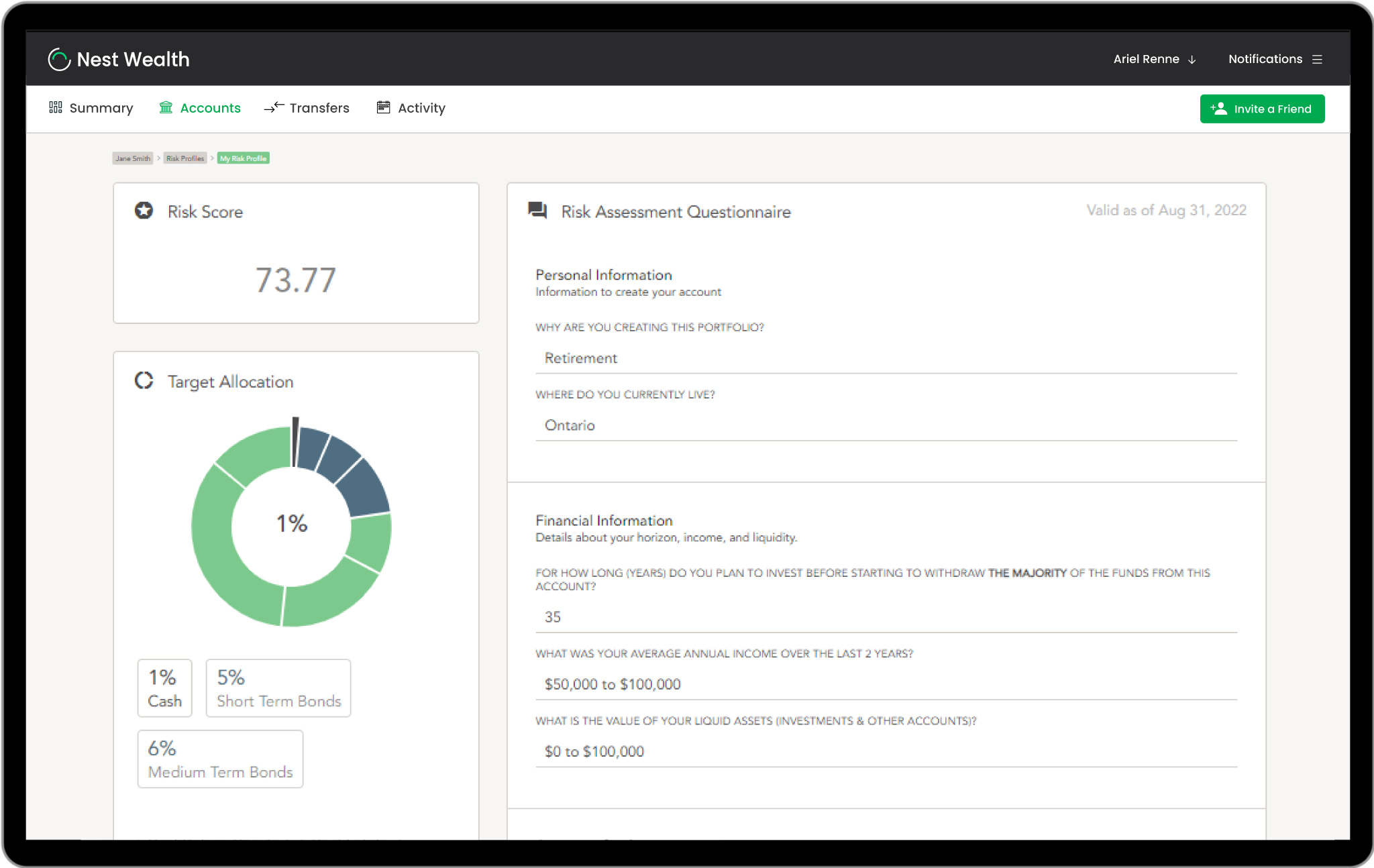

Create your portfolio In minutes

Tailor your personalized portfolio quickly by answering a few simple questions – it takes just five minutes!

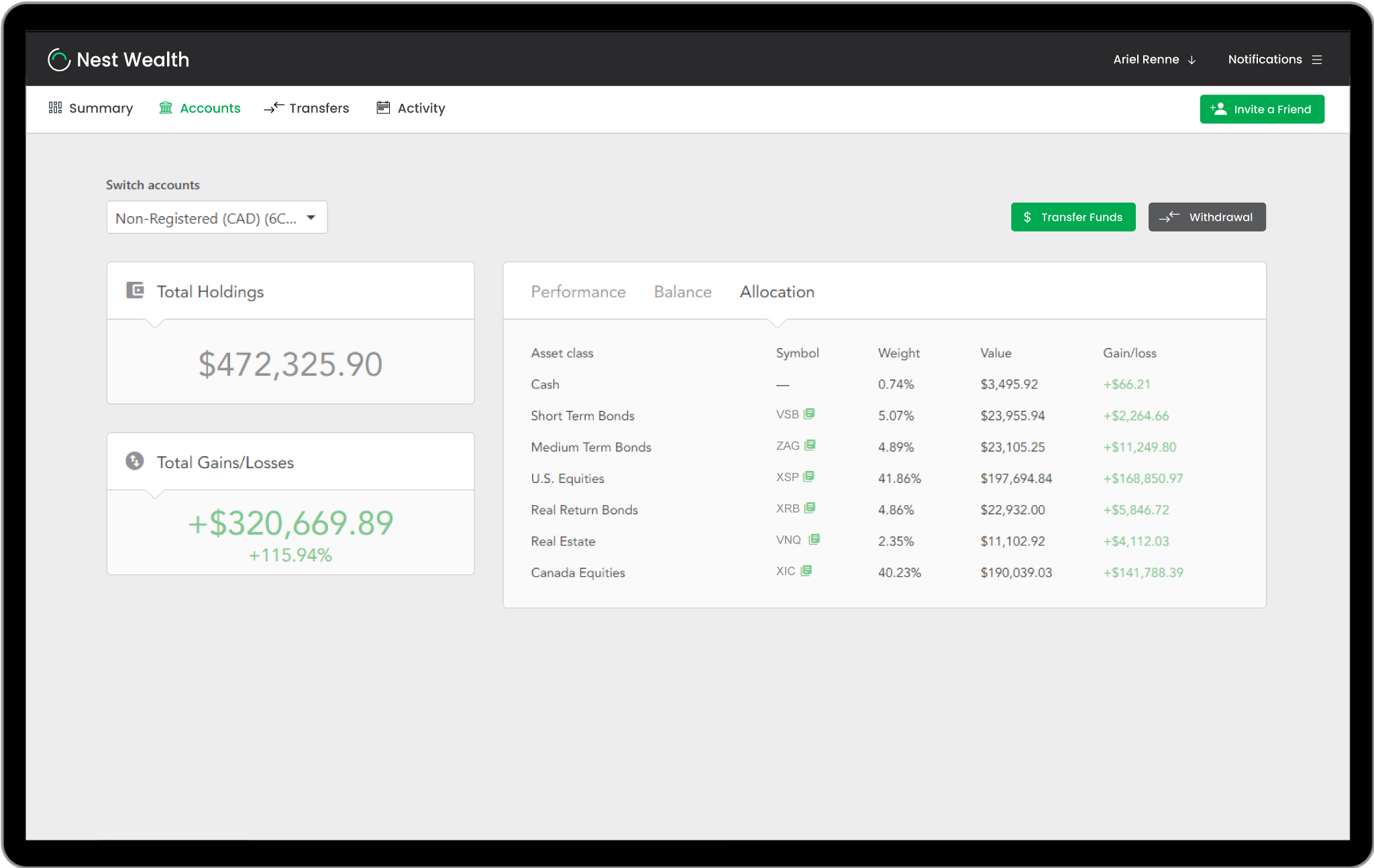

Track your savings online

Witness the growth of your money and keep tabs on your journey towards achieving financial milestones.

Support at your fingertips

Your account is overseen by skilled portfolio managers & our support team is available to assist at every stage whenever you need it.

Nest Wealth Direct

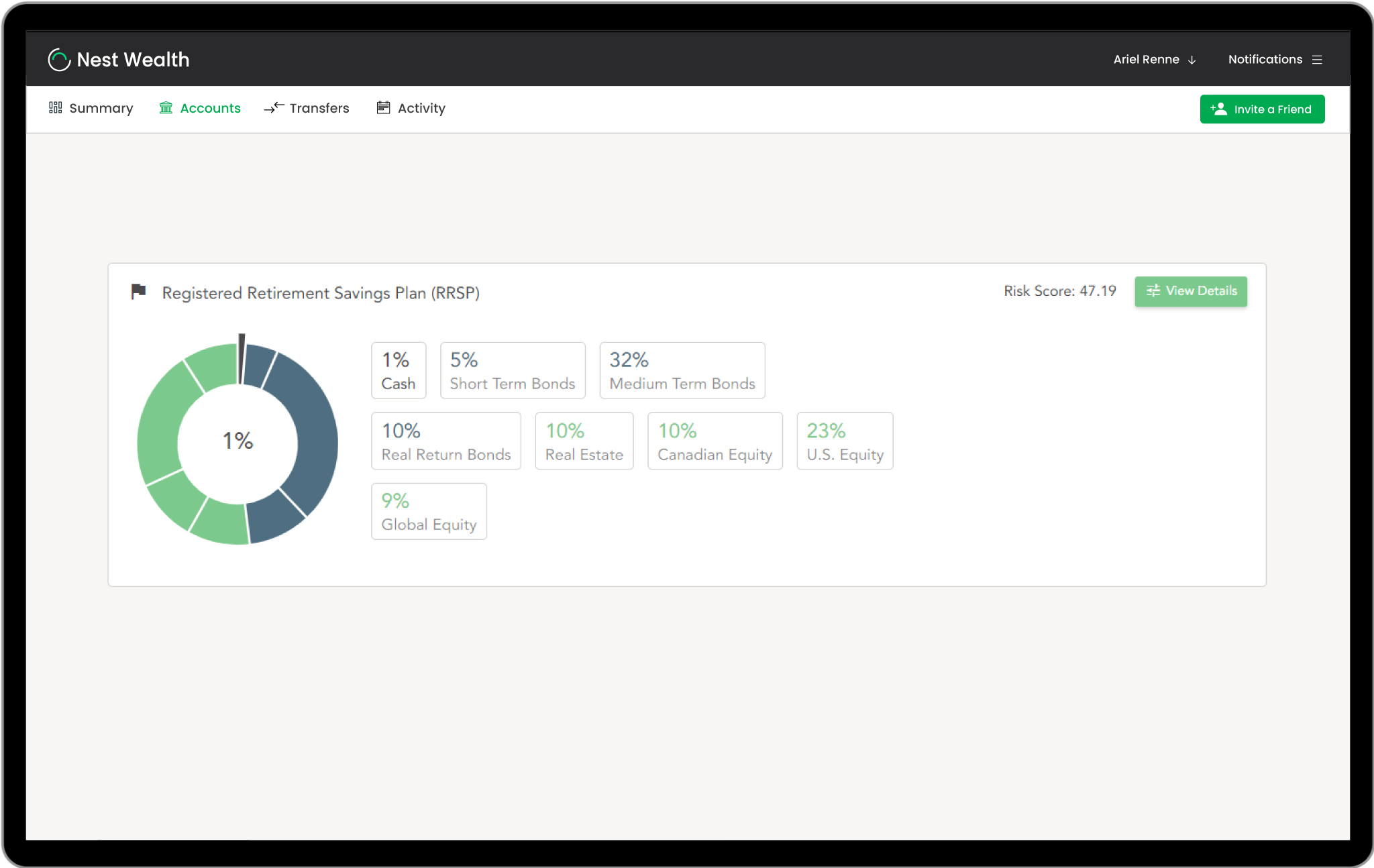

Personalized Portfolios

Your personal financial goals are important to us. That’s why we created personalized portfolios for each & every investor.

Our investment approach

We take a prudent approach to investing, ensuring that we invest your funds across many markets, properly diversified amongst asset classes for the long term, and based on the best empirical research available

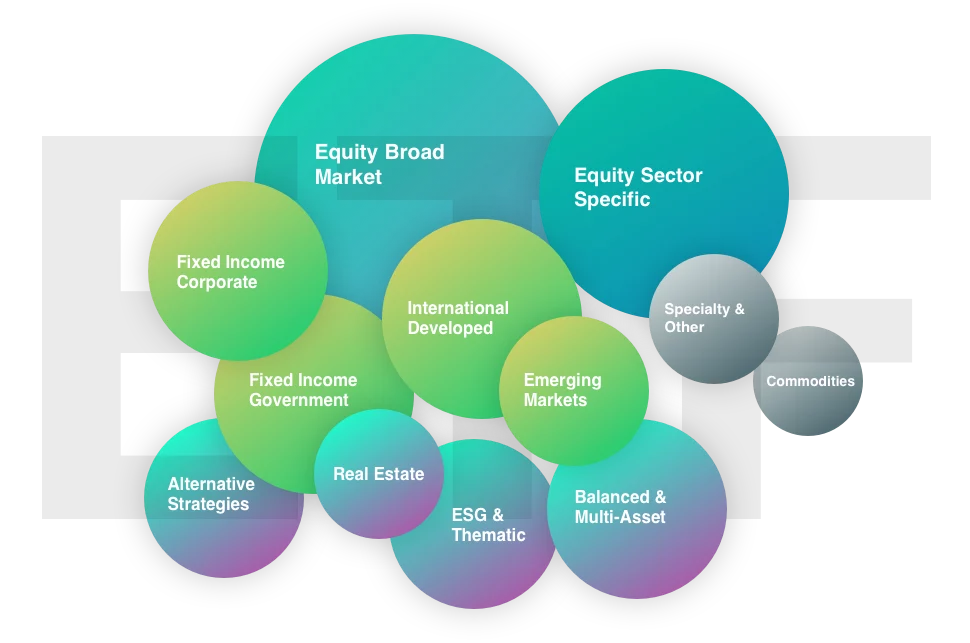

Asset classes

Asset classes are the fundamental building blocks of a portfolio. Your asset mix will take into account your time horizon, risk tolerance and other relevant personal/financial circumstances.

Rebalancing

Creating your customized portfolio is only the starting point of a successful investment strategy. Every step of the way, Nest Wealth will ensure you are working towards your stated financial goals.

The average portfolio Management Expense Ratios (MERs) are 0.13%.

Management Expenses are not charged by us, but indirectly by underlying fund companies, and impact the returns you see as an investor.

Fee structure

Management Fees: Your management fee ranges from $5 a month to $150 per portfolio (client ID) that you hold with us. This fee is for portfolio management and service activities offered by Nest Wealth.

Underlying Management Expense Ratio (MERs): The investments held in your portfolio (ETFs and/or Pooled funds) have a built-in cost charged by the companies managing them. Our passive ETFs MERs range from 0.06% to 0.37%.

Currency Exchange: When we buy or sell US dollars to trade ETFs in your CAD accounts, the custodians charge an additional fee to the exchange/conversion rate used.

Other Custodial Fees: When you open an account through Nest Wealth, your account is held with one of two custodians (NBIN or FCC). During account opening, you will receive additional information about the custodian fees in effect as of this time for other day-to-day administrative requests that can arise.

Bubble sizes represent the approximate AUM of the ETF categories in the Canadian market.

What is An ETF?

An exchange-traded fund (ETF) is an investment fund traded on a stock exchange (like a stock), but holds a basket of investments (like a mutual fund). Most ETFs track broad, well-established indices like the S&P 500 or TSX. ETFs are a low-cost and efficient way to build a diversified investment portfolio. They allow you to gain exposure to a variety of asset classes like bonds, equities and real estate. Learn more about our investment approach with ETFs.

Frequently Asked Questions

Understanding Nest Wealth Direct

Nest Wealth supports almost all types of investment accounts including individual, joint, corporate, and trust accounts with the exception of Registered Disabilities Savings Plans (RDSPs).

For more details, visit the Investment Accounts page.

Our custodian can typically open an account within 24-48 hours. Once an account is open, you can submit funding requests from your bank account or transfer an existing account from another institution.

This largely depends on where the investment account is held currently and whether or not the current institution is a member of the ATON network or not. Here are the general timeframes for the different types of transfers:

- Electronic: 2-4 weeks

- Non-Electronic: 4-6 weeks

We will work with you to determine what the best asset allocation mix is for you based on our existing ETF lineup. Other securities cannot be added or removed from these models but we can modify your cash target based on your short-term liquidity needs.

A Portfolio Manager will reach out to you before we proceed to invest the funds. Before investing the money you’ve deposited, we want to make sure you are comfortable with the answers you have given in the risk questionnaire and also with the proposed asset allocation mix.

Simply log into your Nest Wealth profile and in the ‘Accounts’ section you’ll be able to quickly and safely request a withdrawal.

Our investment minimums are as follows:

Less than $1000 = Account sits in cash

$1000 to $19,999 = Account will be invested in a one-ticket solution

$20,000 + = Accounts will be invested in our customized ETF portfolios

Simply log into your Nest Wealth profile and in the ‘Transfers’ section you’ll be able to quickly and safely request for the money to be transferred from your bank or brokerage account.

There’s no need to visit our office or print off a pile of documents and mail them in. The entire process is carried out electronically on our Web site.

If you have any questions during the process just send us a note to support@nestwealth.com or request a call with us.

Please make sure you have the following on hand:

- A valid, government issued, photo ID

- Online banking login information or copy of a void cheque

- (Optional) – A statement for any existing investment account(s) you would like to transfer over

Find more answers in the FAQs page >

“Nest Wealth” is the trade name of Nest Wealth Asset Management Inc. The products and services advertised are designed specifically for investors in the provinces of AB, BC, MB, SK, PE, NB, NL, NS, QC and ON and may not be available to all investors. Products and services are only offered in accordance with applicable laws and regulations. This website is neither an offer to sell nor a solicitation of an offer to sell securities in any jurisdiction.