Pricing

Understandable fixed fees

Monthly fees that depend only on your portfolio valuation

Direct clients

You know in advance how much our fee is: it only depends on the value of your portfolio.

The average portfolio Management Expense Ratios (MERs) are 0.13%.

Management Expenses are not charged by us, but indirectly by underlying fund companies, and impact the returns you see as an investor.

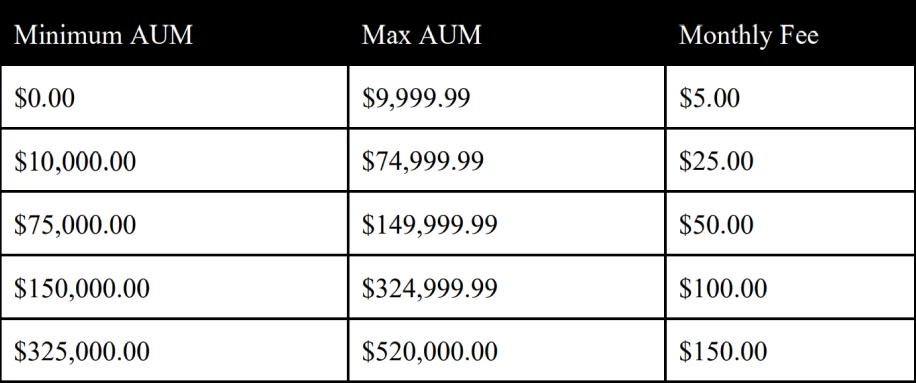

Monthly fees (in Canadian Dollars) are fixed to:

- $5 for an invested portfolio value under $10k

- $25 for an invested value from $10k to under $25k

- $50 for an invested value from $25k to under $150k

- $100 for an invested value from $150k to under $325k

- $150 for an invested value equal or greater than $325k

Referred clients

The annual Investment Management Fee payable to Nest Wealth is 0.35% of the net asset value of assets under management per client, with a minimum of $5 and a maximum of $150 per month.

Fees plus applicable taxes will be collected on a monthly basis by applying 1/12th of the annual service fee against the month end value of the accounts managed by Nest Wealth. Nest Wealth may also pay a Referral fee to your Referrer as outlined in the “Referral Fee Disclosure Statement” provided to you as a separate attachment in your account opening package.

Create your Portfolio now!

Monthly Portfolio Management fees per client

The Investment Management Fee payable to Nest Wealth is 0.35% of the net asset value of assets under management per client.

Fees plus applicable taxes will be collected on a monthly basis by applying 1/12th of the annual service fee against the month end value of the accounts managed by Nest Wealth. Nest Wealth may also pay a Referral fee to your Referrer as outlined in the “Referral Fee Disclosure Statement” provided to you as a separate attachment in your account opening package.

Portfolio Management fees: We offer various pricing solutions for different investor types, including those that are already working with a financial professional when referred to our platform. We provide more information about these fees on our website and through the pricing section of our Investment Management Agreement.

Management Expense Ratio (MER): A Management Expense Ratio (MER) represents the cost associated with owning a fund or ETF. The MER indicates how much a fund or ETF pays in management fees and operating expenses (including taxes) on an annual basis. MERs are generally expressed as a percentage and while this is not charged to you as a separate line item, the MER reduces the returns that you would see as an investor. Please consult our Investment approach page, ETF section, for additional details about the MERs of the products we offer.

Referral Fees: If you were referred to Nest Wealth by your financial professional (“Referrer”), referral fees may be deducted and paid by Nest Wealth to the Referrer. You will receive information about these fees in the disclosure of referral arrangement documents provided to you during the account opening process.

Administrative fees: Our custodians may charge fees for certain activities and services related to the administration of your accounts. Information about these fees is provided by our custodians through the account opening package which may be delivered to you digitally through our platform or through physical mail to your address on file.

You know in advance how much our fee is: it only depends on the value of your portfolio.

The average portfolio Management Expense Ratios (MERs) are 0.13%.

Management Expenses are not charged by us, but indirectly by underlying fund companies, and impact the returns you see as an investor.

Fixed monthly fees

You know in advance how much is our fee: it depends only on the portfolio value bracket.

under $10k

$5

$10k to under $75k

$25

a month

$75k to under $150k

$50

a month

$150k to under $325k

$100

a month

$325k and above

$150

a month

The average portfolio Management Expense Ratios (MERs) are 0.13%.

Management Expenses are not charged by us, but indirectly by underlying fund companies, and impact the returns you see as an investor.