Nest Wealth Plus

Empower your financial business

Your all-in-one Digital Wealth Management solution your clients will understand

Are you a financial professional looking for a simplified and efficient way to manage your clients’ wealth? Nest Wealth provides you with the digital tools, ETF portfolios and support you need. Say goodbye to paperwork and welcome a new era of digital wealth management.

Nest Wealth Plus is a cutting-edge out-of-the-box Digital Wealth Management Platform designed to empower financial professionals to spend less time on compliance and administrative tasks, freeing up more time to do what matters most: advising clients and connecting with new prospects.

NEST WEALTH PLUS

What to expect from Nest Wealth Plus

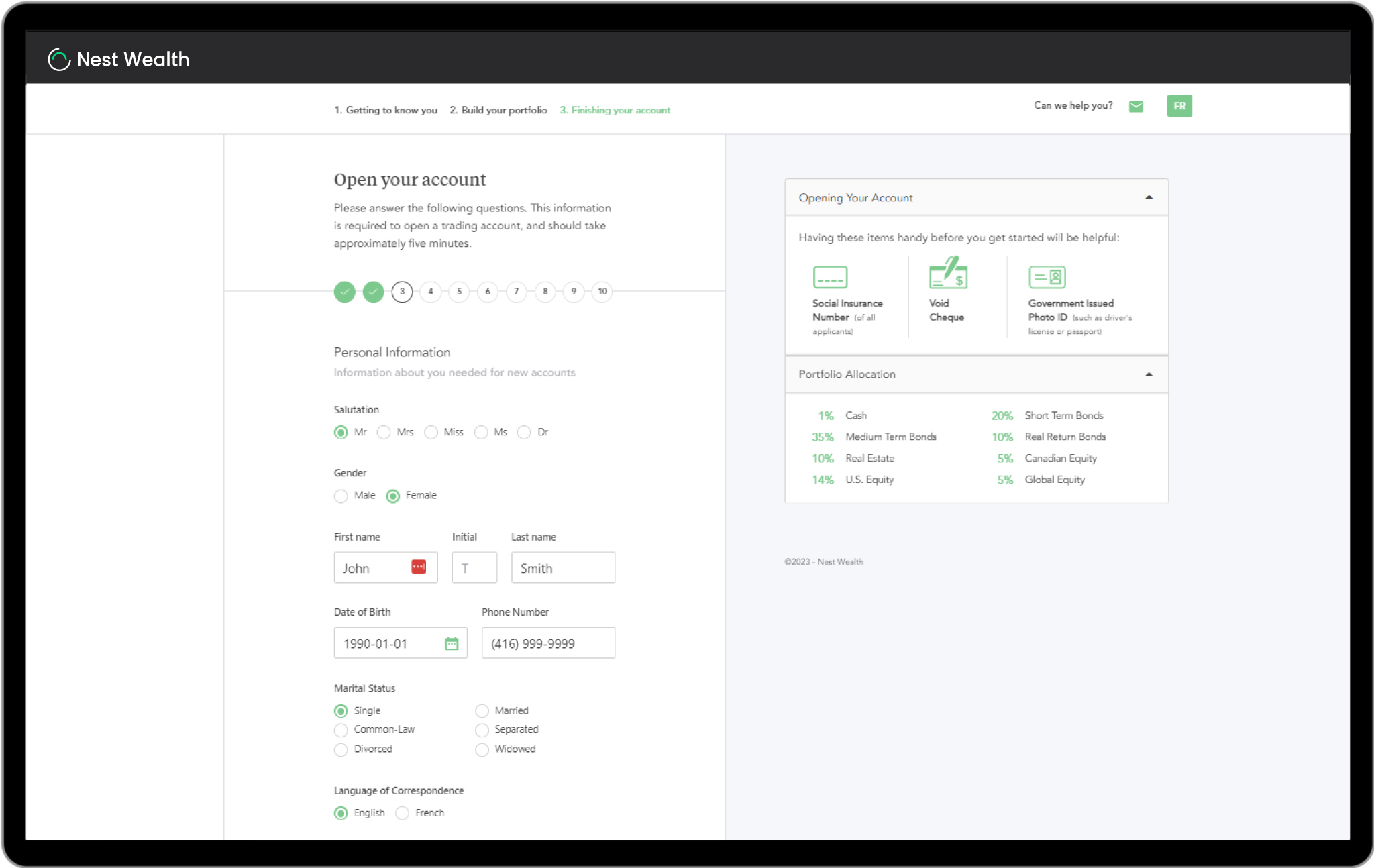

Digital onboarding solution

Say goodbye to lengthy onboarding processes. Nest Wealth Plus offers quick and easy client onboarding. Onboard your clients in under 15 minutes, thanks to paperless user-friendly process.

Rebalancing

We take the hassle out of portfolio management. Nest Wealth monitors portfolio asset allocation and rebalances to ensure it aligns with clients’ goals and risk profile.

Dedicated support teams

Having access to responsive support when you need it is critical to ensuring a great client experience. We offer exceptional support through our Customer Experience and Customer Success teams, ensuring you always have expert assistance when you need it. We are committed to responding within one business day to your inquiries.

Increased revenue

Partnering with Nest Wealth can help increase your revenue since you will get to keep 100% of your referral fees earned through the Nest Wealth Plus referral program.

Customized ETF Portfolios

Nest Wealth Plus simplifies investment management with access to customized ETF portfolios for your clients. We carefully select ETFs that are liquid and have a low tracking error to their underlying index. Lower fees and higher liquidity mean more returns for your clients. Our actively managed investment portfolios are provided to us by Forstrong Global Asset Management.

Seamless book transfer

We work with you to transition your book of business to Nest Wealth Plus platform as quickly and seamlessly as possible, while ensuring an exceptional client experience. There is no AUM minimum required.

The ultimate Wealth Solution for Financial Professionals

Nest Wealth Plus is not just a platform; it is your partner in simplifying wealth management. Focus on your clients: not paperwork. Transition to a digital future with Nest Wealth Plus and experience business independence.

Real results.

Real ROI.

Firms that have partnered with Nest Wealth have seen significant improvements in their onboarding processes, higher client satisfaction, decreases in overhead costs and business growth.

“I’m very pleased with the transition and transfer of my business to Nest Wealth. Their strong competitive advantages include their ability to seek timely solutions, the high-quality support team ensuring client service issues are sorted out with the custodian, and the excellent, easy-to-use client and advisor interfaces. The sign-in as a client feature is first in class compared to the competition.

The RazorPlan financial planning tool is excellent. I find it beneficial to include this in my client service level offering. I use it to project retirement income and to present life insurance sales opportunities. I’m looking forward to having the comfort of a reliable and competent solution for my wealth management business.”

— Ian Thompson | Director, Governance & Analytics, Jones DesLauriers

NEST WEALTH PLUS

Wealth Management platform for different needs

Eliminate compliance burden & offer more value

Defer the “know your client”, “know your product” and suitability responsibility to a portfolio manager.

Boost profitability & eliminate headaches

Outsource low-value activities to improve economies of scale, allowing you to focus more on building new and nurturing existing client relationships without the burden of compliance, administration, and investment management responsibilities.

Offer more value to clients

Add passive and actively managed portfolios to your product shelf for your clients, make money less abstract with our technology and make your clients want to engage more with simple functionality. Provide them with a total online account view with easy access to charts and dashboards.

Transition your practice for the future

Alleviate risk and your administrative burden while maintaining access to client information and improved tracking of all of your client accounts. Best of all, keep more of your revenue and decrease your overhead costs.

Easy client referrals

Our platform makes customer referrals fast, easy and hassle-free.

Offer more value

Our technology makes money less abstract, empowering clients to engage more – a total online account view with easy access to charts and dashboards.

Save your clients money

Our capped monthly fees mean the more your clients invest the more they save. Your clients pay a maximum of $150/month no matter how much they invest.

Get better insights

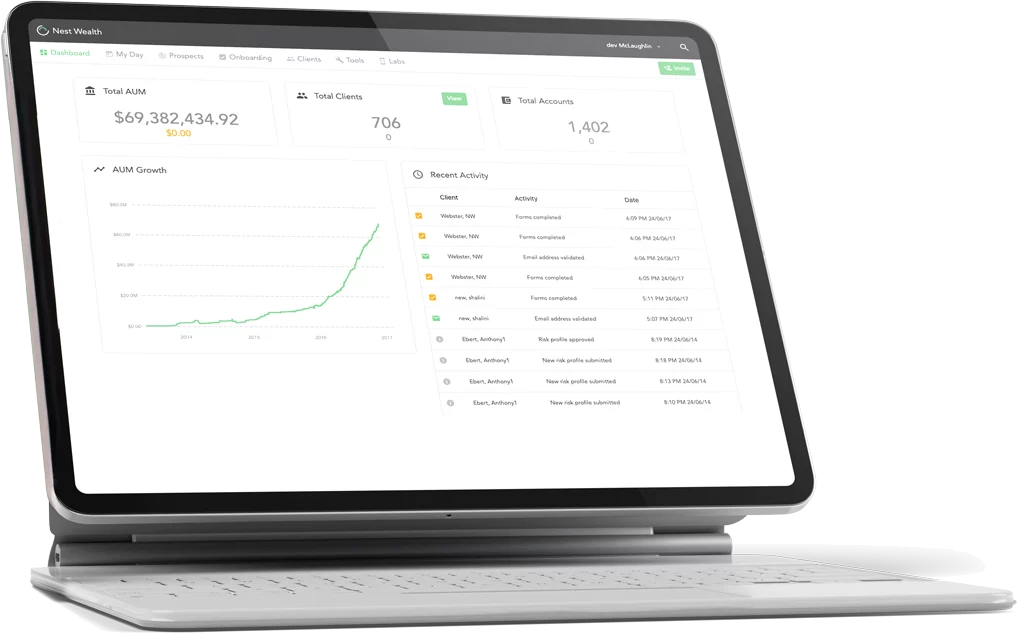

Our advisor dashboard makes it easy to get all the information that powers the financial plan you create.

Diversify your offerings

Add passive and actively managed portfolios to your offerings for your clients.

Strike the right balance

Deliver a win-win proposition that makes you look great in the eyes of your clients.

Save your clients money

Our capped monthly fees mean the more your clients invest the more they save. Your clients pay a maximum of $150/month no matter how much they invest.

Help your Advisor Team reach their full potential

Provide your advisors’ access to passive and actively managed portfolios through an innovative digital platform for Managing General Agents.

Level the playing field for your Advisor.

Improve retention and increase client leads by reaching a broader audience with another product offering.

Flexibility to service all your client segments

We provide you with the support to mitigate risk, decrease compliance burden and improve the client experience overall.

Spend less time manually Entering decumulation strategies In retirement

Spend more time engaging clients in meaningful discussions.

Improve client satisfactionEasily provide better options in a more digestible way

Clearly demonstrate the value you bring to clients with easy-to-read charts and reports.

Create financial plans that clients understand, add life insurance, calculate rate of return, and plan cash flow.

Unleash your digital potential, ask for more information about

To learn more information or request a demo please fill out the form below and our team will be in touch in 1-2 business days.

“Nest Wealth” is the trade name of Nest Wealth Asset Management Inc. The products and services advertised are designed specifically for investors in the provinces of AB, BC, MB, SK, PE, NB, NL, NS, QC and ON and may not be available to all investors. Products and services are only offered in accordance with applicable laws and regulations. This website is neither an offer to sell nor a solicitation of an offer to sell securities in any jurisdiction.