Nest Wealth Direct

Simplified Wealth Management For Individual Investors

One of the Lowest Portfolio Management Fees in Canada

Direct is a sophisticated wealth management solution that allows you to pay less and keep more of your money by offering the lowest portfolio management fees in Canada.

You don’t have to choose between digital and traditional advisors. We offer various pricing solutions for different investor types, including those already working with an advisor. We’ve built a better way for you to invest.

Build A Portfolio in Minutes

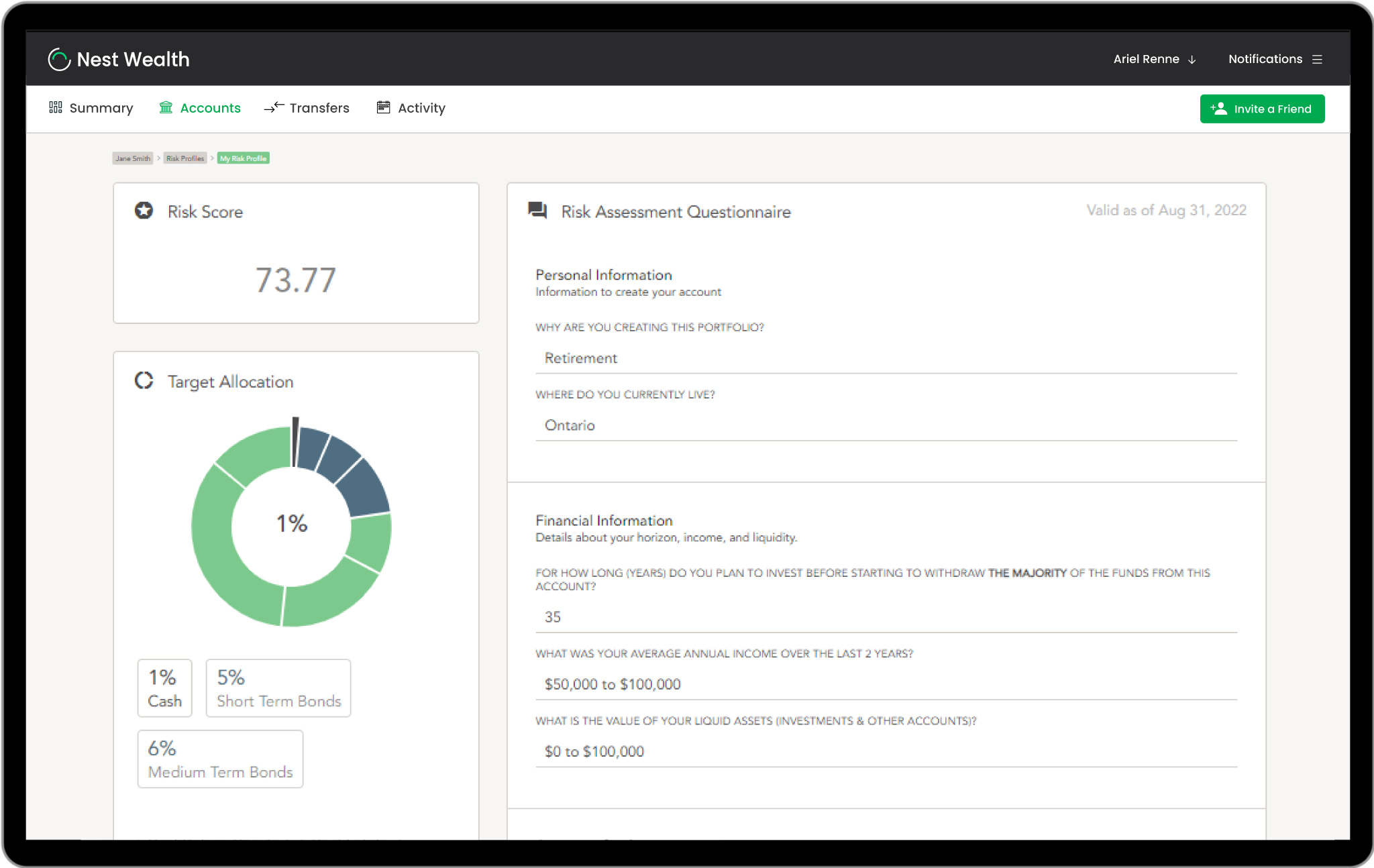

By answering just a few questions, you can build your own personalized portfolio in as little as five minutes.

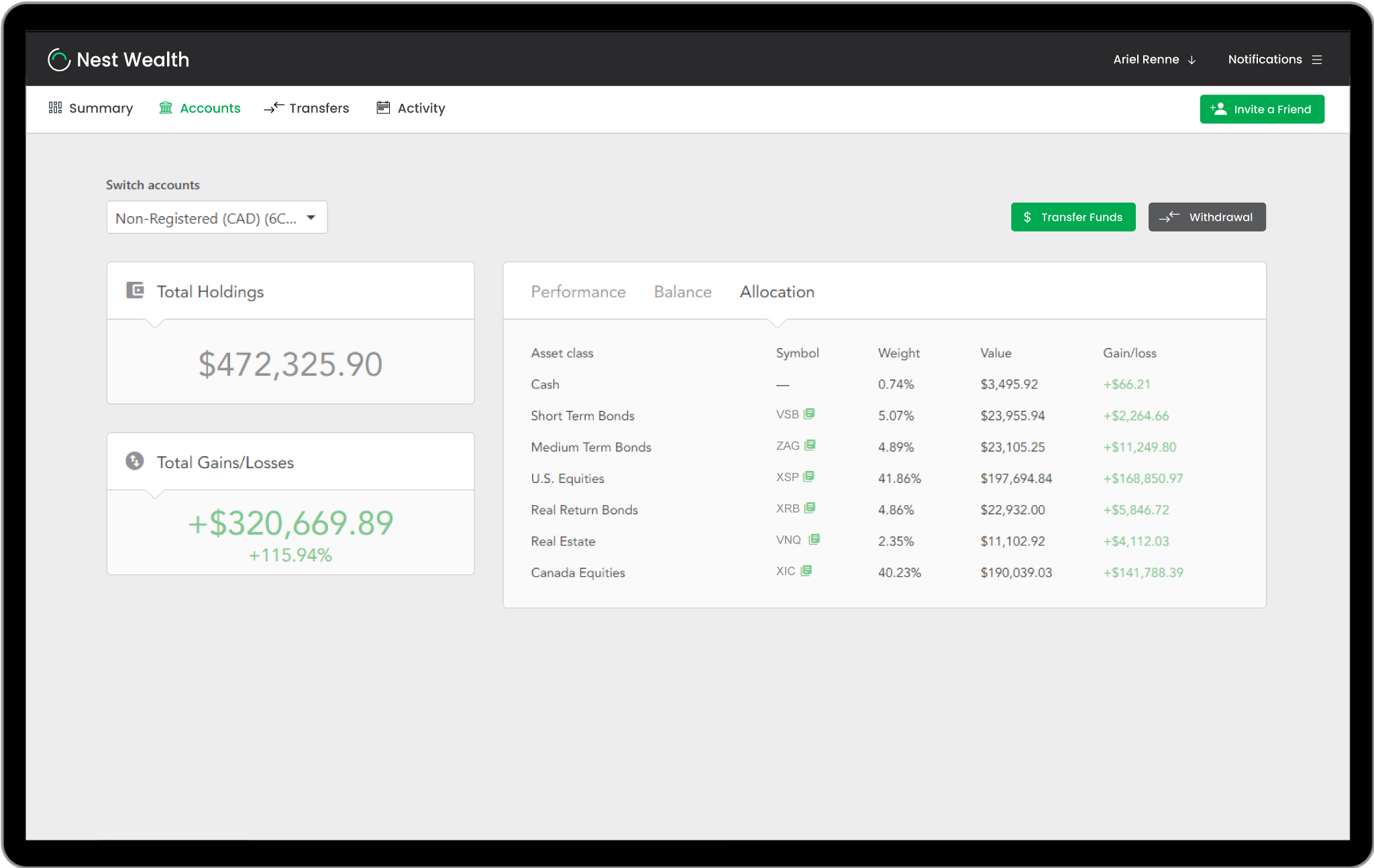

Monitor Your Savings

Watch your money grow and track your progress toward your financial goals

Unlimited Access to Support

Your account is managed by a professional, experienced portfolio manager. Our support team is here to help you every step of the way.

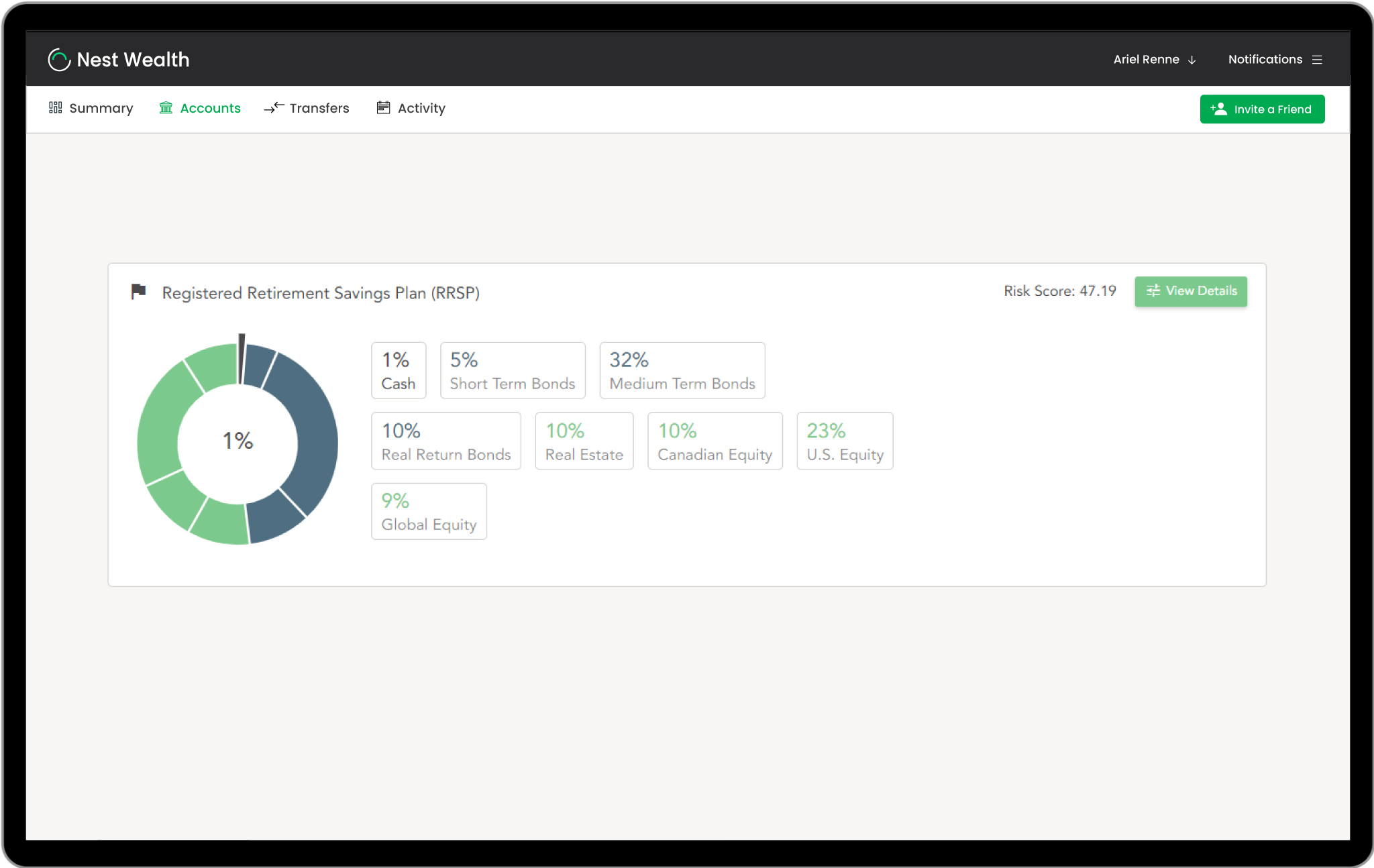

Your personal financial goals are important to us. That’s why we created personalized portfolios for each & every investor.

Direct Offers Personalized Portfolios

Our Investment Approach

We take a prudent approach to investing, ensuring that we invest your funds across many markets, properly diversified amongst asset classes for the long term, and based on the best empirical research available

Asset Classes

Asset classes are the fundamental building blocks of a portfolio. Your asset mix will take into account your time horizon, risk tolerance and other relevant personal/financial circumstances.

Rebalancing

Creating your customized portfolio is only the starting point of a successful investment strategy. Every step of the way, Nest Wealth will ensure you are working towards your stated financial goals.

Fee Structure

Management Fees: Your management fee ranges from $10 a month to $150 per portfolio (client ID) that you hold with us. This fee is for portfolio management and service activities offered by Nest Wealth.

Underlying Management Expense Ratio (MERs): The investments held in your portfolio (ETFs and/or Pooled funds) have a built-in cost charged by the companies managing them. Our passive ETFs MERs range from 0.06% to 0.37%.

Currency Exchange: When we buy or sell US dollars to trade ETFs in your CAD accounts, the custodians charge an additional fee to the exchange/conversion rate used.

Other Custodial Fees: When you open an account through Nest Wealth, your account is held with one of two custodians (NBIN or FCC). During account opening, you will receive additional information about the custodian fees in effect as of this time for other day-to-day administrative requests that can arise.

What is An ETF?

An exchange-traded fund (ETF) is an investment fund traded on a stock exchange (like a stock), but holds a basket of investments (like a mutual fund). Most ETFs track broad, well-established indices like the S&P 500 or TSX. ETFs are a low-cost and efficient way to build a diversified investment portfolio. They allow you to gain exposure to a variety of asset classes like bonds, equities and real estate.*

Get Started & Build Your Portfolio

“Nest Wealth” is the trade name of Nest Wealth Asset Management Inc. The products and services advertised are designed specifically for investors in the provinces of AB, BC, MB, SK, PE, NB, NL, NS, QC and ON and may not be available to all investors. Products and services are only offered in accordance with applicable laws and regulations. This website is neither an offer to sell nor a solicitation of an offer to sell securities in any jurisdiction.