Financial Planning – Razorplan

Innovate Financial Planning Software For Advisors

Quickly & Easily Create Financial Plans. Your Clients Will Understand

With a powerful engine under the hood, RazorPlan simplifies complex processes to help your clients focus on what’s important.

You are in full control to provide advice at a level of complexity suited to your individual client needs. RazorPlan’s unique design combines a “Big Picture” analysis with straightforward goals-based planning.

What Is

RazorPlan?

RazorPlan is a financial planning software program that takes minimal time to complete and is centered on engaging clients through meaningful discussions and needs analysis.

How Does It Work?

RazorPlan uses innovative algorithms with key client data to perform intuitive calculations generating powerful client reports. This method allows you to quickly analyze your client’s needs while helping them understand the importance of your recommendations.

RazorPlan is used by investment advisors, insurance advisors and financial planners to provide:

- Detailed Cash Flow Modeling

- Retirement Planning & Decumulation Optimization

- Asset Management & Tax Planning

- Risk Management & Insurance Planning

- Personal & Corporate Estate Planning

Financial planning can be complicated and getting client buy-in is crucial to both your client relationship and their financial success. Advisors who use RazorPlan are confident that their clients understand the financial plan and act on their recommendations.

Whether you are conducting an annual review, meeting with a prospective client or presenting a full financial plan, RazorPlan has a report for the situation.

RazorPlan uses current Canadian T1 tax calculations and provides regular updates for legislative changes. For business owners, RazorPlan calculates the impact of RDTOH and CDA.

Get answers to your questions from the Nest Wealth team focused on your success. Our customer success team includes CFPs who know the software and can help you get results.

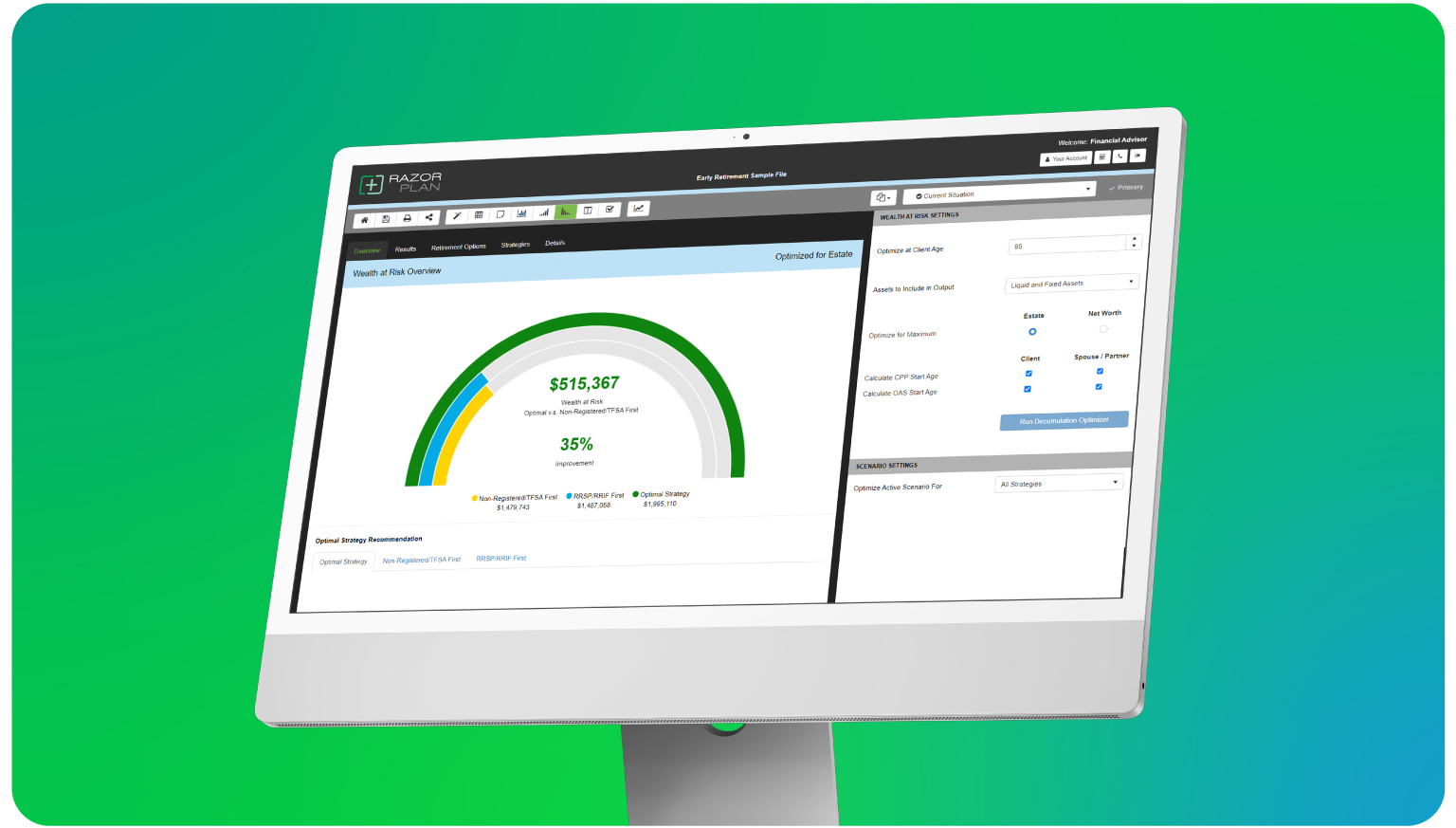

Simplified Retirement Income Planning Software

RazorPlan with decumulation

RazorPlan with Decumulation is an optimization tool for the decumulation phase of a client’s life. It provides an unbiased recommendation on how to reduce the risk of outliving their money, while achieving their after-tax lifestyle and estate goals. Built into the RazorPlan platform, this tool adds to the analysis provided by RazorPlan.

- Automatically determine the optimal retirement withdrawal strategy to either maximize the estate or maximize retirement income.

- Compare the optimal strategy to conventional strategies of drawing down from either registered accounts first or non-registered account first.

- Identify optimal ages to start both Canada Pension Plan (CPP) and Old Age Security (OAS).

- Complement the existing retirement and estate planning strategies created in RazorPlan.