Relationship Disclosure

Version 3.0, May 5, 2025

At Nest Wealth, we strive to serve your financial needs by providing you with access to investment advice that takes your personal objectives into account. For this reason, we would like you to have a good understanding of:

- Our products and the services we offer;

- Your account(s) and how we operate client accounts; and

- Our relationship with and responsibilities to you.

To ensure you make the most of your experience with us and to foster a mutually successful relationship, we encourage you to:

Keep us Up to Date: It is important that you provide us with complete and accurate information so we can properly advise. You should also promptly notify us of any change to your personal circumstances, such as a change to your income, employment, net worth, address or marital status.

Keep us Informed: You should understand the potential risks and returns associated with investments and review the risks outlined in our Investment Management Agreement. Where appropriate, we encourage you to consult professionals, such as lawyers or accountants, for legal and/or tax advice that we cannot offer you as a portfolio manager.

Stay on Top of your Investments: We encourage you to review all account documentation provided by us and our custodians, including account statements and other reports.

Ask us Questions: If you have any questions related to the contents of this document or need to update any information we have on file for you, please contact us at support@nestwealth.com.

Section 1 — Nest Wealth Products & Services

Standard offerings: Nest Wealth Asset Management Inc. (“Nest Wealth”) is registered as a Portfolio Manager (“PM”) in British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, Quebec, Newfoundland & Labrador, New Brunswick, Nova Scotia, and Prince Edward Island.

As a portfolio manager, we exclusively provide managed account services to Canadian investors. This means we have the discretion to invest, reinvest and maintain your account invested in a portfolio that is suitable for you, and must act in your best interests. The suitability of your account investments is based on the Information we collect about you through our digital platform and through our discussions with you. The information we collect at the time of account opening, and update on an annual basis or whenever there is a change, includes information regarding your personal and financial circumstances, investment needs and objectives, risk profile (tolerance and capacity), investment time horizon and investment knowledge (collectively, “KYC Information”) This information is then used to determine the suitability of any potential investment actions.

In addition to the above noted KYC Information, we also collect (and require that you keep us updated on) information regarding whether you are an insider of a reporting issuer, along with other required information for the purposes of our anti-money laundering and foreign tax reporting obligations.

Other services: Our related entity, Objectway Financial Solutions Inc., offers digital solutions to financial advisors and other industry participants to help improve the quality of advice and other service offerings in our industry. This includes digital solutions related to financial planning and investment advice.

New services: You can learn about new services by visiting our website, www.nestwealth.com or through information included in email communications that we may send from time to time.

For a full list of products and services, and the relevant commissions and fees, please contact us, visit our website at www.nestwealth.com, or refer to our Client Investment Management Agreement and other account opening documentation provided by our custodians. and other account opening documentation provided by our custodians.

Location Restrictions: As a Portfolio Manager (PM) registered with provincial authorities in Canada, we may be unable to offer you advisory services if you do not permanently reside in Canada. In some cases, there may also be adverse tax consequences to investing with a Canadian-based asset manager while residing in another country. Restrictions vary by jurisdiction. If you are a non-resident, we strongly encourage you to consult with an accountant or tax specialist prior to initiating a new account application with us.

Product Restrictions: You should be aware of the following restrictions which pertain to our offering:

- We do not purchase or hold mutual funds with deferred sales charges (DSC).

- You cannot invest in securities outside of the investment solutions we have selected to use in our model portfolios, which are discussed in more detail on our website.

- We do not accept in-kind transfers, nor can we advise you on securities that you may hold externally with another institution or advisor (“legacy securities”).

- As a discretionary portfolio manager, Nest Wealth is not obliged to act on client investment instructions or accept client-directed trades. Please refer to Section 2 for more information on how we operate our managed accounts.

Section 2 — Understanding Managed Accounts

Managed Account: Your account is managed by members of Nest Wealth’s portfolio management team that are registered with provincial securities commissions. Our advising representatives have an obligation to assess whether any investment action is suitable for you.

To assess suitability, our representatives rely on the KYC Information collected about you through our digital solution as well as through ongoing discussions with you. In addition, we have an obligation to “know” and understand each investment we purchase for your account. This process is known as the “know your product” (KYP) policy and requires that we analyze factors including, but not limited to, the structure, features, risks, initial and ongoing costs associated with the investment, as well the impact of those costs, the reputation and track record of the investment product and/or its manager, the potential for profit and loss, potential conflicts of interest, the investment’s time horizon and the concentration of investments in your account.

Our risk profile questionnaire (RPQ) and digital onboarding is meant to let us understand your investment needs and objectives, investment time horizon, investment knowledge, risk profile (tolerance and capacity) and other relevant personal and financial circumstances.

Investment Methodology: Our model portfolios consist of Exchange Traded Fund (ETF) model portfolios. Based on your risk score, we invest you into an asset mix which our advising representatives believe to be suitable for you. Please refer to our website or further details about these investment alternatives and our investment process.

Personal Information Updates: We rely on the information that we have on file about you to manage your portfolio and rely on you to keep us informed about big changes in your life so we can properly advise you. By signing our investment management agreement prior to opening an account with us, you agree to update your account information when material changes happen in your life such as a change of employment, change of address, change in income, or any other change that might change the information on the risk profile that we have on file for you. As a PM offering managed accounts, we are required to confirm and/or update your applicable KYC Information on an annual basis. If you have any questions about updating your portfolio or risk profile, please contact us at investors@nestwealth.com.

Digital Advice vs. Traditional Advice Models: You understand that compared with traditional “in-person” advisory firms, person to person contact may be more limited through our service. To help keep you informed, we provide you with 24/7 access to your account online so you can review your account balances, transaction history, account statements, account performance, and other account related information. Of course, we understand that questions do arise and so we also encourage you to contact our support team if you have any questions or concerns.

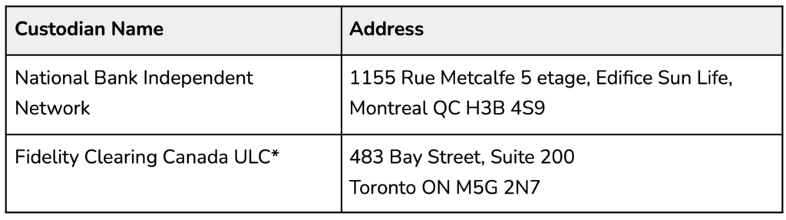

Custodial Arrangements: As a PM, Nest Wealth does not hold custody of your assets. When you open an account with us, your accounts are held by a custodian appointed by us and we manage the assets in that account.

The custodians that we presently work with are referenced in the table below:

The custodians we have selected are qualified Canadian custodians under applicable securities laws. Each Custodian is independent of Nest Wealth, is required to segregate client assets from its own assets and is subject to regulatory oversight, minimum capital and insurance requirements. The Custodian may hold securities on behalf of the client in its name or as nominee of the client.

Section 3 — Risks To Consider

Investment Risk: Which we assess your investment needs and objectives, personal and financial circumstances, investment time horizon, investment knowledge and risk profile to provide you with a recommended investment portfolio. It is important that you understand that if you invest with us, you are not guaranteed to see positive investment returns.

At Nest Wealth, most of the investments we will make for you will be in ETF portfolios. ETFs fluctuate in value daily and will generally reflect changes in the value of the underlying investments which may fluctuate based on market events including but not limited to changes in interest rates, economic conditions, news and political events.

There are risks associated with investing and the greatest risk to you as an investor is that you could lose all or part of your investment.

Leverage Risk: Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, you are responsible for the repayment of any loans you take and pay interest on any borrowed amounts even if the value of the securities that you purchase declines. We do not recommend using short-term debts such as lines of credit or credit cards to invest with us.

Custodian Risk: Our custodians are qualified custodians under applicable securities laws. Each custodian is independent of Nest Wealth, is required to segregate client assets from its own assets and is subject to regulatory oversight, minimum capital and insurance requirements.

Client assets are subject to risk of loss if:

(i) if the Custodian becomes bankrupt or insolvent;

(ii) if there is a breakdown in the Custodian’s information technology systems; or

(iii) due to the fraud, willful or reckless misconduct, negligence or error of the Custodian or its personnel.

On an ongoing basis, we assess our custodians’ relevant internal controls and ability to deliver custodial services effectively. Through these reviews, we aim to ensure that the custodians’ system of controls and supervision is sufficient to manage risks of loss to our clients in accordance with prudent business practice.

Interest Rate Risk: When investing in fixed income securities or securities that are highly impacted by interest rates, there is a risk that changes in interest rates will have an impact on the value of those securities.

Concentration Risk: Concentration risk exists when security holdings are focused on a particular issuer, group of issuers, industry, sector, country or region and may result in increased volatility and a greater risk of financial loss than if security holdings are more diversified.

Currency Risk: When investing in securities denominated in currencies other than the Canadian dollar, such investments may be impacted by changes in the value of the Canadian dollar in relation to the value of the currency in which the security is denominated.

Other Risks: Please refer to our Investment Management Agreement for a complete list of other risks that you should be aware of as an investor using our services.

Section 4 — Account Fees

Portfolio Management Fees: We offer various pricing solutions for different investor types, including those that are already working with a financial advisor when referred to our platform. We provide more information about these fees on our website and through the pricing section of our investment management agreement.

Management Expense Ratio (MER): A Management Expense Ratio (MER) represents the cost associated with owning a fund or ETF. The MER indicates how much a fund or ETF pays in management fees and operating expenses (including taxes) on an annual basis. MERs are generally expressed as a percentage and while this is not charged to you as a separate line item, the MER reduces the returns that you would see as an investor. These fees are charged within the applicable fund or ETF and are not directly charged to your account but will impact the reported return of the fund or ETF. Please consult our ETF page for additional details about the MERs of the products we offer.

Referral Fees: If you were referred to Nest Wealth by your financial professional (“Referrer”), referral fees may be deducted and paid by Nest Wealth to the Referrer. You will receive information about these fees in the disclosure and acknowledgement of referral arrangement documents provided to you during the account opening process which, among other things, will detail the method of calculating the referral fee and to the extent possible, the amount of the fee.

Administrative Fees: Our custodians may charge fees for certain activities and services related to the administration of your accounts. Information about these fees is provided by our custodians through the account opening package which may be delivered to you digitally through our platform or through physical mail to your address on file.

Ongoing fees can reduce the value of your investment portfolio. This is particularly true over time, because not only is your investment balance reduced by the fee, but you also lose any return you would have earned on that fee. Over time, even ongoing fees that are small can have an impact on the value of your investment portfolio.

Nest Wealth will provide 60 days’ notice prior to any change in or introduction of new fees impacting your account.

Section 5 — Conflicts Of Interest

As a portfolio manager, we have a fiduciary responsibility to act with care, honestly, in good faith, and always in the best interests of our clients.

Conflicts of Interest: A conflict of interest includes any circumstance where Nest Wealth or an employee of Nest Wealth has an interest that may conflict with the interests of a client or the ability of Nest Wealth or one of its employees to deal with clients fairly in a manner consistent with the best interests of the client.

We have adopted policies and procedures to help us identify and manage conflicts of interest that may exist as part of our relationship and provide you with more information about these potential or actual conflicts below. We will try to avoid conflicts where possible, and in all other cases disclose the conflict, and/or manage it through our policies and procedures. Conflicts deemed too significant to be addressed through controls or disclosures will be avoided. Disclosures will be made in a timely and meaningful manner.

Management of Conflicts of Interest: The way in which we deal with different conflicts of interest will differ depending on the extent and severity of a specific conflict:

-

- Avoidance: This includes avoiding conflicts that are prohibited by law, as well as conflicts that cannot effectively be addressed in a client’s best interest.

- Management: We manage acceptable conflicts through means such as by implementing specific procedures and solutions

- Disclosure: For certain conflicts, we will provide you with meaningful information about the conflict so you can assess its significance and make a well-informed decision.

We note that disclosure alone is not sufficient to manage a material conflict of interest and as such, will additionally manage or avoid any material conflict of interest to ensure we are always acting in the clients’ best interests.

Possible Conflicts: Below, we outline potential or actual conflicts of interest that may arise as part of our relationship with you and details about how we address them.

| Potential Conflict of Interest | Addressed By | Risk to Client | How Nest Wealth Manages the Potential Conflict of Interest |

|---|---|---|---|

| Conflicts Arising from Proprietary Products

It is an inherent conflict of interest to recommend or purchase securities of issuers that are related, connected to or managed by the firm, to clients of the firm.

|

Avoidance | If this conflict of interest is not managed properly, this conflict may result in clients being placed in proprietary products that are less suitable or have inferior performance or other characteristics when compared to other potential alternatives, due to the financial benefit to Nest Wealth and/or its related entities. | Nest Wealth manages this conflict of interest through avoidance as it does not utilize proprietary products. |

| Conflicts arising from Related Offerings

It is an inherent conflict of interest to recommend the use of additional services offered by Nest Wealth or an affiliated entity. |

Avoidance | If this conflict of interest is not managed properly, there is a risk that the client may be referred to or may be recommended services from a related entity that are not suitable or in the client’s best interest. | Nest Wealth manages this conflict through avoidance as neither Nest Wealth, nor any affiliated entities, offer additional services to clients of the firm. |

| Conflicts arising from internal compensation arrangements and incentive practices

While motivating registered individuals and firms to generate revenue or grow assets is normal practice, some compensation practices can result in behaviour that is not in the best interest of clients as a result of incentives to add clients, or assets or revenue generated from clients.

|

Control and Disclosure | If this conflict of interest is not managed properly, registered individuals may be financially incentivized to place their interests ahead of the clients and may make decisions for personal financial reasons rather than based on client suitability. | Nest Wealth addresses this conflict through controls and disclosure. Nest Wealth registered individuals are required to only provide services and make investments that are suitable for the applicable client and are subject to oversight by the firm’s compliance department. |

| Conflicts of interest at supervisory level

If Nest Wealth’s compliance or supervisory staff’s compensation is tied to sales or revenue generation of the firm overall, there is an inherent conflict of interest to put their interests ahead of clients’ interests.

|

Avoidance | If this conflict of interest is not managed properly, supervisory personnel may be financially incentivized to place their interests ahead of the clients and may not provide proper oversight or supervision. | Nest Wealth avoids this by not having supervisory staff with compensation tied to sales or revenue generation and does not assign sales or revenue targets to staff who have compliance or supervisory roles. |

| Conflicts arising from third-party compensation

Nest Wealth may receive trailing commissions from third party mutual fund companies.

|

Control and Disclosure | If this conflict of interest is not managed properly, clients may be paying duplicate fees due to the structure of certain products and/or Nest Wealth may be incentivized to select products that include third party compensation.

|

Nest Wealth manages this conflict by not charging duplicate management fees and through its suitability obligations to ensure that only suitable investments are made for clients. |

| Conflicts in fee-based accounts

Nest Wealth offers only fee-based accounts for its portfolio management clients.

|

Control and Disclosure | If this conflict of interest is not managed properly, clients may be unsure of their fee arrangement with Nest Wealth and there may be confusion as to which services are included in the fees they pay. | Nest Wealth discloses all fees and charges at the time of account opening. Nest Wealth also provides an annual report on fees and operating charges paid each calendar year. |

| Differing fee arrangements

Where a client is charged more than other clients for the same or substantially similar products or services, potential conflicts of interest may arise.

|

Control and Disclosure | If this conflict of interest is not managed properly, clients may not be aware of the opportunity to negotiate management fees and certain clients may receive the same services for a lower fee, without the knowledge of clients that there are different fee schedules or certain criteria leading to different fee schedules. Additionally, if this conflict is not appropriately managed, Nest Wealth may give preferential treatment to higher fee-paying clients. | Nest Wealth manages this conflict as it has established a standardized fee schedule to ensure clients are treated fairly, honestly, and in good faith. Fees may vary from this schedule in certain circumstances due to certain client accounts being subject to employee/family discounts, referral arrangements or other circumstances such as the level and complexity of the services to be provided to the client. |

| Addressing conflicts between clients (fair allocation of investment opportunities)

There can be competing interests among clients, and a registrant may have difficulty trying to address these conflicts in the best interest of all their clients simultaneously.

|

Control and Disclosure | If this conflict of interest is not managed properly, certain clients may receive preferential treatment and better access to certain investments or investment opportunities with limited availability. | Nest Wealth manages this conflict by implementing a fair allocation of investment opportunities policy which is disclosed to clients.

|

| Purchasing assets from clients outside of the normal course of business

The purchase of an asset from a client outside of the normal course of business may create a material conflict of interest. |

Avoidance | If this conflict of interest is not managed, there may be potential situations in which an employee of Nest Wealth breaches its fiduciary duty by participating in a transaction with a client outside of the ordinary course of business, or the client may reflect negatively on the transaction.

|

Nest Wealth prohibits engaging in transactions with clients outside of the ordinary course of business. |

| Conflicts related to referral arrangements

Nest Wealth may enter into referral arrangements whereby it receives referred clients and pays ongoing referral fees to referral parties who have written referral agreements with Nest Wealth. |

Control and Disclosure | If this conflict of interest is not managed properly, referred clients may be unaware of the compensation received in respect of their account or may be charged additional fees to account for the referral fee paid by Nest Wealth. | Nest Wealth manages this conflict as it has policies and procedures related to entering into referral arrangements with third parties and providing referral specific disclosure to clients. Nest Wealth’s portfolio management fee does not vary between referral arrangements to ensure that all clients are treated equally, irrespective of whether they are a referred client or not. Clients receive disclosure at the time of account opening which outlines the nature of the relationship and the amount of referral fee paid or received and must consent to the payment of such fees, prior to any payment to the referral party. Nest Wealth may provide referral parties with access to or discounted use of certain financial planning software offered by Objectway Financial Solutions Inc., a related entity of Nest Wealth, based on the total assets that have been referred by such referral party. Nest Wealth manages this conflict of interest by ensuring that any services it provides to such referred clients are suitable and in the best interests of the client, irrespective of the origination of such client.

|

| Full control or authority over the financial affairs of a client

Having full control or authority over the financial affairs of a client in an inherent conflict of interest. |

Avoidance | If this conflict of interest is not managed properly, an employee of Nest Wealth may be in a position to appoint themselves or ensure they continue to manage the client’s assets without any independent oversight.

|

Nest Wealth avoids this conflict by declining any appointments. |

| Individuals who serve on the board of public companies

Material conflicts of interest arise if an individual acts as a director of a non-affiliated firm or acts as a director of a reporting issuer. Materiality is determined on a case-by-case basis.

|

Control and Disclosure | If this conflict of interest is not managed properly, employees of Nest Wealth may be put in a position where they are conflicted in their duties to act in the best interest of clients/the firm by virtue of their duty to the other registrant firm or publicly listed company. Additionally, they may become aware of material non-public information and be unable to advise on certain securities and/or may be viewed as acting on a conflict of interest in buying certain securities on behalf of clients.

|

Nest Wealth manages this conflict as all outside activities or relationships, such as directorships or trusteeships of any kind, or paid or unpaid roles with charitable organizations, must be approved, in advance, by Nest Wealth’s Chief Compliance Officer (CCO). Nest Wealth maintains policies and procedures to ensure that registrants do not act upon any material non-public information and appropriate safeguards are put in place to prevent improper trading in those impacted securities.

|

| Individuals who have outside activities

Material conflicts of interest arise if an individual engages in activities outside of their employment with the firm, including other business ventures or volunteer positions.

|

Control and Disclosure | A conflict of interest may arise as a result of a Nest Wealth registrant’s outside activities (OA). A conflict may arise from activities due to time commitment, their position or any compensation received. The OA may hinder their ability to perform their duties, may give rise to confusion as to which entity the individual is representing or the employee may be in a position of influence.

|

Nest Wealth controls this as registrants must disclose all outside activities on an ongoing basis. A monthly reminder is also circulated to registrants. All outside activities are reviewed with the Chief Compliance Officer (CCO) to confirm if a conflict of interest exists and where applicable implement controls to deal with the conflict of interest. Employees provide an annual attestation.

|

| Trade Execution – best execution

When placing orders for and on behalf of clients’ accounts, Nest Wealth has an obligation to obtain best execution of trades for client accounts.

|

Avoidance | If this conflict of interest is not managed properly, clients may end up paying excessive or higher than normal trade costs. | Nest Wealth avoids any best execution conflicts it trades exclusively through its custodians. Nest Wealth reviews the best execution policy and materials provided by the custodians annually to ensure the custodians are providing satisfactory services and meeting its best execution obligations.

|

| Use of client brokerage commissions – soft dollar arrangements

When placing orders for and on behalf of clients’ accounts, firms may receive “soft dollars” as a result of selecting a particular broker for their transactions.

|

Avoidance | If this conflict of interest is not managed properly, Nest Wealth may be incentivized to utilize certain brokers for trades due to the benefits that the firm receives, and such brokers may charge higher fees or provide lower quality broker services than other available brokers.

|

Nest Wealth avoids any soft dollar conflicts as it does not enter into any soft dollar arrangements.

|

| Cross Trades

Where securities are purchased for the account of a responsible person or client at a time when another account of a responsible person or client is a seller of such securities, it is an inherent conflict of interest because of the potential benefit to the account of a responsible person or other client, potentially at the expense of another firm client.

|

Avoidance | If this conflict of interest is not managed properly, Nest Wealth or its representatives may execute trades for the benefit or themselves or other clients to the detriment of another client or clients. | Nest Wealth does not permit inter-account trades. |

| Trading and Pricing Errors

Nest Wealth may have a potential conflict of interest when determining when, and how, to deal with a client account error. The risk is that Nest Wealth may not to take steps to correct or otherwise address the error due to the cost or other implications to Nest Wealth.

|

Control | If this conflict of interest is not managed properly, clients may end up disadvantaged due to trading and pricing errors caused by the firm. | Nest Wealth manages this by having its policy that in the event that there is a material trading or pricing error, the error will be corrected for the benefit of the client(s). |

| Valuation of portfolios

As Nest Wealth’s revenue is based on a percentage of the market value of each client’s account, Nest Wealth may have a conflict of interest in those instances where Nest Wealth is responsible for valuing portfolio securities. The valuation of a client’s account will impact the fees earned by Nest Wealth and the performance reported to clients as well as marketed.

|

Control | If this conflict of interest is not managed properly, portfolio values may be inflated or marked improperly to create additional revenue as fees are charged as a percentage of assets under management. | Nest Wealth has policies and procedures in place which involve valuation checks and balances including external pricing, valuation and reconciliation processes. |

| Employees/access persons could benefit from trading with knowledge of portfolio transactions for clients. (e.g. front running a trade)

Individuals may find themselves in situations where their personal interests are in conflict with those of a client. When individuals at Nest Wealth invest in the same securities as clients of Nest Wealth, there is a perceived or potential conflict of interest that such individuals at Nest Wealth may benefit from opportunities at the expense of Nest Wealth’s clients.

|

Control and Disclosure | If this conflict of interest is not managed properly, employees of Nest Wealth may be trading ahead of clients and/or acting on information improperly for their own gain, which may be to the detriment of clients. | Nest Wealth has policies and procedures in place which require pre-approval of all personal trades. |

| Using inside information for personal gain

Conflicts of interest arise when individuals have access to inside information and complete trades ahead of client orders for their personal benefit.

|

Avoidance, Control and Disclosure | If this conflict of interest is not managed properly, employees of Nest Wealth may be trading ahead of clients and acting on information improperly for their own gain, which may be to the detriment of clients. | Nest Wealth avoids the use of inside information conflict as it prohibits the use of material non-public information for personal gain. Nest Wealth manages the personal trading conflict as it requires pre-approval of all personal trades.

|

| Tied Selling

It is an inherent conflict of interest where purchase of one service is conditional on buying another as well, which is prohibited by securities laws. |

Avoidance | If this conflict of interest is not managed properly, clients may feel obligated to maintain their relationship with Nest Wealth or one of its related entities in order to continue receiving their desired services.

|

Tied selling is prohibited by Nest Wealth. |

| Gifts and Entertainment

There may be instances wherein Nest Wealth’s individuals may give or accept gifts or business entertainment of more than minimal value in connection with Nest Wealth’s business and as such a perceived or potential conflict of interest could arise.

|

Control | If employees were to receive excessive gifts or entertainment they may be influenced to purchase or recommend products to clients that are not appropriate, suitable or in the clients’ best interests. | Nest Wealth manages the gifts and entertainment conflict as its gifts and entertainment policy sets limits on the value of gifts and entertainment received by Nest Wealth personnel and the value of gifts and entertainment that Nest Wealth may provide to clients or prospects. |

| Marketing with misleading or inaccurate performance

Nest Wealth has an interest in showing good performance to attract more clients which may conflict with Nest Wealth’s fiduciary responsibility to its clients and prospective clients to provide accurate performance reporting.

|

Control | If this conflict of interest is not managed properly, clients may be influenced to invest with or use Nest Wealth’s services based on improperly presented or misleading information. | Nest Wealth controls this conflict as it has developed comprehensive policies and procedures for the review and approval of all marketing material. |

| Proxy Voting

There is a potential conflict of interest as there is the opportunity for Nest Wealth to vote securities or to agree to certain corporate actions in its own interest over the interests of clients.

|

Control

|

If this conflict of interest is not managed properly, clients’ securities may not be voted in the best interests of the clients or may not be voted at all, to the detriment of clients. | Nest Wealth has policies and procedures in place with respect to proxy voting to ensure that if proxies are voted, it is done in the best interests of clients. |

| Complaints

There is a potential conflict of interest if a complaint is received and not responded to as it may adversely affect an individual or the firm. |

Control and Disclosure | If this conflict of interest is not managed properly, client complaints may not be appropriately addressed, and improper activity may not be properly remedied. | Nest Wealth controls this conflict of interest through policies and procedures and makes disclosure to clients regarding such policies, as well as third party resources clients may pursue when making complaints.

|

“Related” may be said to involve positions permitting, through ownership or otherwise, a controlling influence, and would include all companies under a common controlling influence. “Connected” may be said to involve a state of indebtedness to, or other relationship with, the registrant or those “related” to the registrant that, in connection with a distribution of securities, would be material to a purchaser of the securities. Currently, Nest Wealth has no related or connected issuers. In the event that relationships with “related” or “connected” issuers are established in the future, Nest Wealth will maintain a list of such issuers and will make such list available to its clients by posting the list on Nest Wealth’s website and keeping it updated. If a specific conflict with a “related” or “connected” issuer arises, Nest Wealth will provide affected clients with disclosure about the specific conflict with that issuer.

Objectway Financial Solutions Inc. is a related entity of Nest Wealth which offers software-as-a-service (SaaS) to financial advisors and other industry participants to help improve the quality of advice and other service offerings in our industry.

Section 6 — Client Reporting

Account Statements (Nest Wealth): You will receive quarterly statements from us which outline the same detailed information as the custodian statements but presented on a quarterly basis. These statements are posted and made available to you through our client portal. Upon request, we will provide you with monthly statements.

Account Statements (Custodians): You will receive account statements from our custodians monthly, or quarterly if no transactions are executed on a given quarter. These statements outline your account activity over a specific period of time such as purchases and sells of securities, contributions, withdrawals, dividends, interest, transfers, grant payments and any other transactions that may have occurred in the time period covered by the statement. These statements also list your current holdings and the net value of your portfolio.

If your accounts are custodied with FCC, statements will be made available to you through our client portal. For clients with accounts custodied with NBIN, the custodian will mail physical copies to your address on file unless you enroll for digital delivery through NBIN’s MyPortfolio+ service.

Annual Investment Performance Report: The Annual Performance Report is designed to help you better understand how your investments are performing. It contains information about your personal rates of return net of any fees, and it also contains information about changes in the value of your accounts over a given calendar year and since the inception of your account. We generate this report on an annual basis during January and make this available to you in the client portal on the “Statements” section.

Annual Fees Disclosure Report: The Annual Fee Disclosure Report is a summary of investment-related charges you have paid during the calendar year. Our report will summarize for you management fees, referral fees, and taxes on these fees charged to you during a given calendar year. We generate this report on an annual basis during January and make this available to you in the client portal on the “Statements” section.

Our custodians will also make available to you their own Annual Fees Disclosure document which will outline other administrative fees that the custodian may charge from time to time for activities such as partial de-registrations of a registered account. Our custodians will make this report available to you on or about January of each year.

Tax Reporting: Depending on your specific account types and/or investment activity for the year, our custodians will generate tax documentation.

If your accounts are custodied with FCC, tax documentation will be made available to you through our client portal. For clients with accounts custodied with NBIN, the custodian will mail physical copies to your address on file unless you enroll for digital delivery through NBIN’s MyPortfolio+ service.

Section 7 — Complaint Handling Process

Step 1: Client Experience: We manage large volumes of client inquiries on most days, and our support team strives to provide you with the best possible client experience. If you have issues or concerns that you would like us to investigate further, please contact our support team at support@nestwealth.com.

Step 2: Director of Customer Success: If our support team is unable to resolve your concerns or if you feel that your concerns have not been addressed or resolved to your satisfaction, please contact our Customer Success Director at support@nestwealth.com subject line “Attention Director of Customer Success” so we can learn more about your issue and try to find a resolution.

Step 3: Compliance Department: If you are unable to resolve your concerns with our support team or with the Director of Customer Success, you can send your concerns in writing to the Compliance team at compliance@nestwealth.com.

In each case above, where a complaint is made, we will send you an acknowledgement of receipt within five business days of receiving your complaint. In this acknowledgement, we may request additional information to investigate your complaint. We will provide you with a substantive response within ninety (90) calendar days of receiving your complaint.

If we are unable to respond to your complaint within the above time frame, you will be provided with a written explanation for the delay and an estimate of when a full response is expected to be sent to you.

In the decision letter, we will provide you with a summary of your complaint, the results of the investigation, an explanation of the final decision, and other options you may have for seeking compensation if you are not satisfied with the response.

Step 4: Ombudsman for Banking Services (OBSI): If our firm is unable to help you resolve your concerns, clients have the option to escalate their concerns to the Ombudsman for Banking Services and Investments (“OBSI”). OBSI is an independent dispute resolutions service that is available to you at no cost. More information about this process can be found in the OBSI’s services brochure provided at the time of account opening and upon receipt of a complaint.

Section 8 – Trusted Contact Person & Temporary Holds

At the time of account opening and periodically thereafter, Nest Wealth will ask you to designate a trusted contact person (“TCP”). By designating a TCP, you authorize Nest Wealth to contact the TCP and disclose information regarding your investments to your TCP in the following circumstances:

- possible financial exploitation of yourself;

- concerns about your mental capacity as it relates to your financial decision making or lack of decision-making;

- the name and contact information of any of the following:

- a legal guardian of yourself,

- an executor of an estate under which you are a beneficiary;

- a trustee of a trust under which you are a beneficiary, or

- any other personal or legal representative of yourself; or

- your current contact information.

In certain circumstances, Nest Wealth may place a temporary hold on your investments. A temporary hold means a hold that is placed by Nest Wealth on the purchase or sale of a security on your behalf or on the withdrawal or transfer of cash or securities from your account. Nest Wealth will not place a temporary hold on your accounts unless we reasonably believe that:

- you are a vulnerable client;

- you have been financially exploited, financial exploitation is occurring, has been attempted or will be attempted; or

- we reasonably believe that you do not have the mental capacity to make decisions involving financial matters.

Should a temporary hold be placed on your accounts we will provide you notice of the temporary hold and the reasons for the temporary hold as soon as possible.

We will continue to review the relevant facts on an ongoing basis to determine if continuing the hold is appropriate. Within 30 days of placing the temporary hold and, until the hold is revoked, we will update you on a monthly basis to inform you if we have revoked the temporary hold or provide you with notice of our decision to continue the hold, and the reasons for that decision.

Section 9 – Fair Allocation Policy

In some cases, where it is practical and possible, orders for portfolios of the same security are grouped and entered as a block order. Each account receives its pro rata share and the same blended price of each fill wherever practicable. Partial fills are allocated equitably on a pro-rata basis across all accounts for the asset class except on the rare occasion that minimum transaction charges will make this uneconomic for the client (i.e. transaction expenses are too high compared with the value of the transaction). Brokers are asked to hold uneconomic partial fills until such time as the transaction becomes large enough to be allocated fairly amongst all relevant accounts in a cost-effective manner. Each account receives its pro rata amount, rounded to a board lot. This process is repeated until the entire position is purchased. If the broker is not able to hold the partial fill until it is economic for all accounts, then fills are allocated to those accounts for which it is economic. This applies equally to orders for initial public offerings that are only partially filled.

Section 10 — Other Information

Address Updates: If you move, it is important that you update our support team with your new address as timely as possible. Failure to update your address in a timely manner can result in restrictions being placed on your account by our custodians, which may impair our ability to service your account effectively.

Privacy & Confidentiality: By signing our investment management agreement, you consent to the sharing of your information as outlined in our Privacy and Security policies. We strongly encourage you to review these policies carefully prior to deciding to use our service and to contact our team if you have any questions.

Electronic Communications: By signing up for our service, you understand that our process for providing investment advice is largely delivered through electronic means, and that notices will be delivered to you electronically as described in our investment management agreement.

Benchmarks: An investment performance benchmark is a market or industry sector index against which you can measure the relative performance of your investment. By comparing your investment to an appropriate benchmark, you can see how your investment performed compared to the market or industry sector in general.

Benchmarks should reflect a similar asset class, industry sector and/or risk level, so that they are comparable to the investment you are comparing the performance to. We do not currently, and we do not intend to, provide our clients with any benchmark comparisons.

Updates to this Document: Nest Wealth may from time to time make updates to the contents of this document. We will ensure that clients are made aware of any materials changes via or email or through the online portal and will post the most current version of this document on our website.

Errors: You understand that it is important for you to review carefully and promptly your account statements and other documentation (as requested) to make sure that there are no unintentional errors that may have arisen.

If you identify any errors in your account statement, you must notify us within a reasonable time period from receiving the statement so that our team can help to amend any errors.

Disclosures & Important Information

*Fidelity Clearing Canada ULC (FCC) is an indirect wholly owned subsidiary of 483 Bay Street Holdings LP, which is a joint venture between FIL Limited and Fidelity Canada Investors LLC. FCC and two other separate related legal entities are also Canadian securities registrants – Fidelity Investments Canada ULC and Fidelity (Canada) Asset Management ULC – conduct business under the “Fidelity Investments” brand, which is a trademark of Fidelity Investments Canada ULC and a registered business name of FCC. However, each Canadian securities registrants operates and conducts its business independently of each other. FCC is a member of and regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund (CIPF), which provides limited protection for property held by a member firm if the member firm becomes insolvent.

National Bank Financial (NBF) acting through its National Bank Independent Network division (NBIN), which is an indirect, wholly owned subsidiary of National Bank of Canada (NBC). NBIN’s offices are located at Suite 3000, 130 King Street West, Toronto, Ontario. NBC is a federally regulated Schedule I bank and a public company listed on the TSX. NBF is a member of and regulated by CIRO and is a member of the Canada Investor Protection Fund, which provides limited protection for property held by a member firm if the member firm becomes insolvent.