Investment approach

Invest with personalized portfolios

We recognize every investor is unique. That’s why we create a personalized portfolio tailored to your specific goals and objectives.

Our investment approach

David Swensen, the head of the Yale Endowment Fund, is one of the most recognized professionals in the investment industry.

We build and manage your portfolio based on his three rules. In his book, Unconventional Success, he suggests the following:

Asset class diversification

Investors should maintain exposure to six core asset classes for diversification. These asset classes include domestic equities, emerging market equities, international equities, government bonds, real-return bonds, and real estate.

Using innovative technology and industry-tested investment rules, Nest Wealth creates a low-cost diversified portfolios built specifically for your life goals. Once you’re invested, we take care of monitoring and rebalancing your portfolio so you can get on with enjoying your life. We build your investment portfolio from seven different Exchange-Traded Funds (ETFs) that represent seven different asset classes. You’ll own a different proportion of each of these ETFs based on your risk score, which takes into account what you’re saving for, when you’ll need the money, and how reactive you are to market ups and downs.

Exchange-Traded Funds (ETFs)

ETFs are a low cost and effective way to build a diversified investment portfolio. They allow you to gain exposure to a variety of asset classes like bonds, equities and real estate. Many ETFs track well-established indices like the S&P 500 or TSX and can provide diversification across many markets at a low cost.

Exchange-Traded Funds (ETFs)

ETFs are a low cost and effective way to build a diversified investment portfolio. They allow you to gain exposure to a variety of asset classes like bonds, equities and real estate. Many ETFs track well-established indices like the S&P 500 or TSX and can provide diversification across many markets at a low cost.

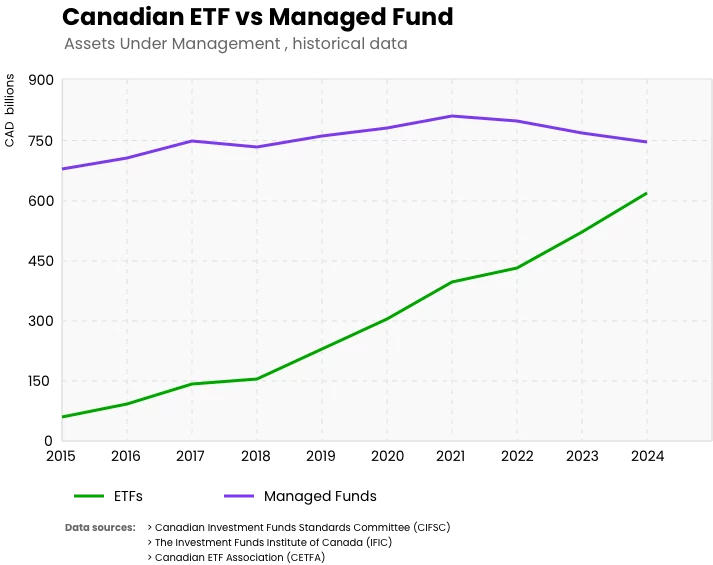

The following charts show the ETFs strong momentum:

- ETFs have shown approximately 2.6x faster penetration rate than Managed Funds

- While Managed Funds still maintain a much larger absolute market size, ETFs are gaining market share at a significant pace

- Both fund types experienced a dip in 2022 (likely due to market conditions), but ETFs recovered more strongly

GENERATED BY CLAUDE.AI 3.7 Sonnet

PROMPT USED:

Prepare a chart with the plot of the assets under management in Canada, starting in 2015 until 2024, with two lines comparing investments in ETF versus investments in Managed Funds, using the more appropriate sources: CIFSC, IFIC, or CETFA, and indicating which source each data set come from.

Convert the code using SVG , HTML and JS if necessary.

Make the code responsive, in order to let the chart stretch from a min width of 400px to a max width of 1200px.

Scale the right (MAnaged Funds) axis in order to respect the same growth rate as of the ETF funds; the goal is to compare the grow rate of both the fund types

USEFUL AI REPLIES

Key Trends in Canadian Investment AUM (2015-2024)

Key Trends in Canadian Investment AUM (2015-2024)

Based on data from the Canadian ETF Association (CETFA) for ETF assets and the Investment Funds Institute of Canada (IFIC) for managed funds:

ETF Growth:

- ETF assets grew from $90 billion in 2015 to $407.8 billion in 2024

- This represents a 353% increase over the decade

- Only one year (2022) showed a slight decline, likely due to market conditions

Managed Funds:

- Managed fund assets grew from $1.24 trillion in 2015 to $2.03 trillion in 2024

- This represents a 63.7% increase over the same period

- Also experienced a decline in 2022 before recovering

Comparative Analysis:

- While managed funds maintain a significantly larger asset base, ETFs are growing at a much faster rate

- The ratio of managed fund AUM to ETF AUM decreased from 13.8:1 in 2015 to 5:1 in 2024

- ETFs are steadily gaining market share in the Canadian investment landscape

The data demonstrates the continued growth of both investment vehicles in Canada, with ETFs showing particularly strong momentum despite representing a smaller portion of total assets.

s:

ETF Growth:

- ETF assets grew from $90 billion in 2015 to $407.8 billion in 2024

- This represents a 353% increase over the decade

- Only one year (2022) showed a slight decline, likely due to market conditions

Managed Funds:

- Managed fund assets grew from $1.24 trillion in 2015 to $2.03 trillion in 2024

- This represents a 63.7% increase over the same period

- Also experienced a decline in 2022 before recovering

Comparative Analysis:

- While managed funds maintain a significantly larger asset base, ETFs are growing at a much faster rate

- The ratio of managed fund AUM to ETF AUM decreased from 13.8:1 in 2015 to 5:1 in 2024

- ETFs are steadily gaining market share in the Canadian investment landscape

The data demonstrates the continued growth of both investment vehicles in Canada, with ETFs showing particularly strong momentum despite representing a smaller portion of total assets.

Key insights from this visualization:

- ETFs have shown approximately 2.6x faster growth rate than Managed Funds over this period

- While Managed Funds still maintain a much larger absolute market size, ETFs are gaining market share at a significant pace

- Both fund types experienced a dip in 2022 (likely due to market conditions), but ETFs recovered more strongly

Data source – Both charts are based on annual Asset Under Management (AUM) amounts, as reported by the Investment Funds Institute of Canada (IFIC) in its 2024 Investment Funds Report and in the SIMA Monthly Investment Fund Statistics – December 2025

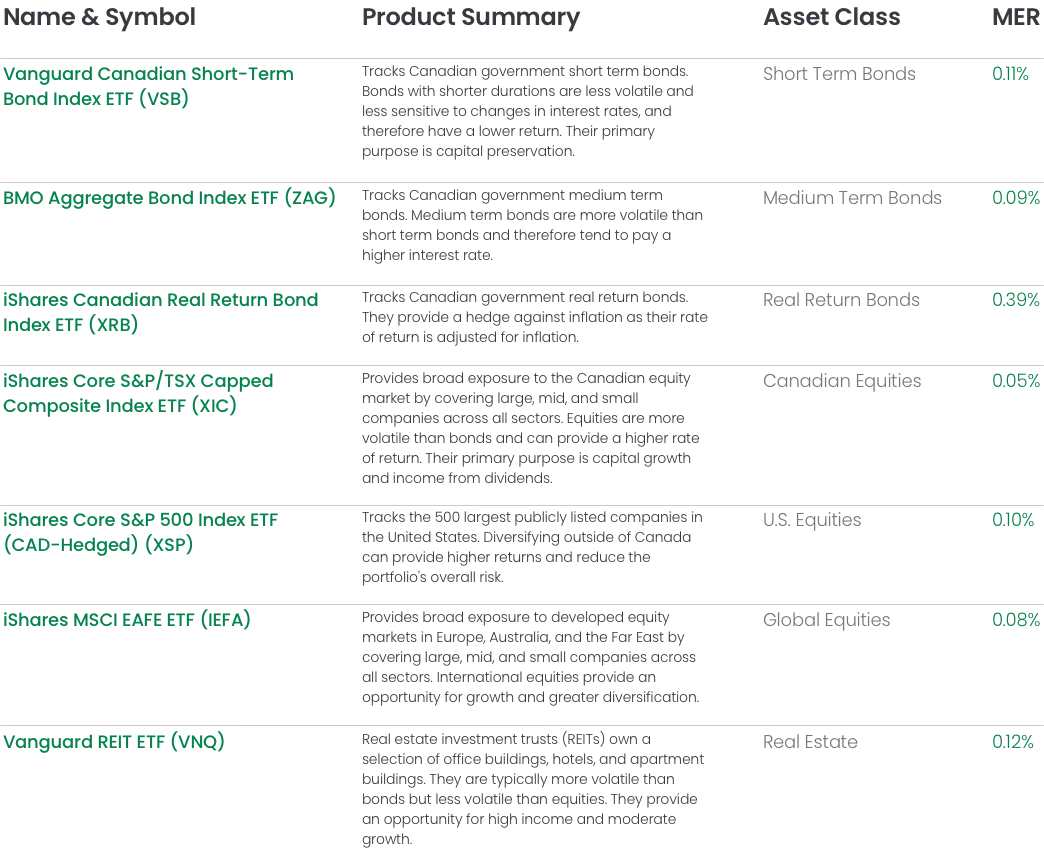

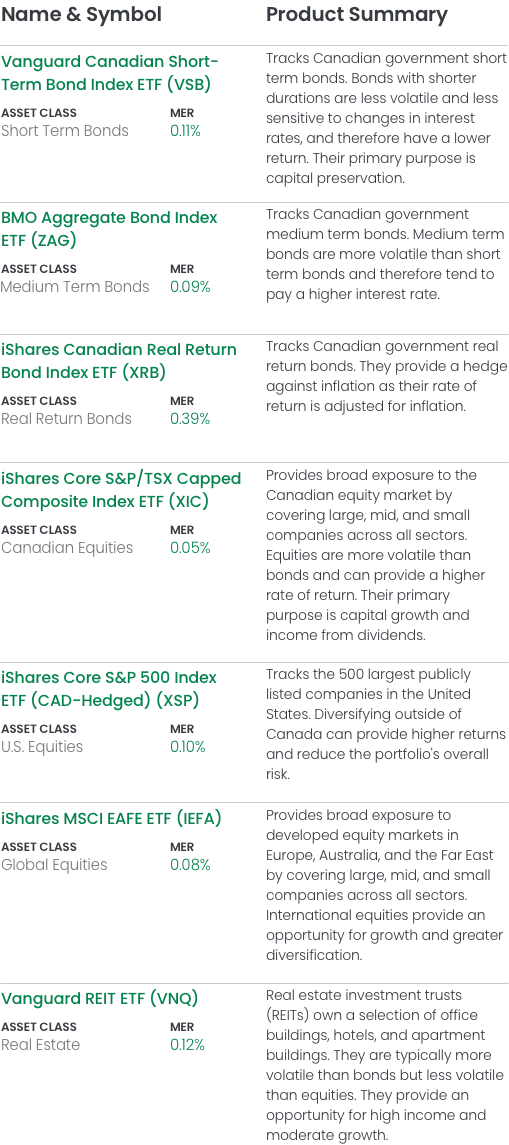

ETF selection process

We select what we believe are the best ETFs available in each asset class, making sure they work well together. We look for ETFs that are low cost, liquid, and have a low tracking error to their underlying index.

Low management expense ratios (MERs) mean you pay less in fees so you keep more of your returns (more wealth for you!). High liquidity means your portfolio is easier to rebalance and your money is readily accessible when you need it. Finally, a lower tracking error just means the ETF is more efficient at its job of mimicking an index.

ETF lineup

Vanguard Canadian Short-Term Bond Index ETF (VSB)

Short Term Bonds

Tracks Canadian government short term bonds. Bonds with shorter durations are less volatile and less sensitive to changes in interest rates, and therefore have a lower return. Their primary purpose is capital preservation.

MER: 0.11%

BMO Aggregate Bond Index ETF (ZAG)

Medium Term Bonds

Tracks Canadian government medium term bonds. Medium term bonds are more volatile than short term bonds and therefore tend to pay a higher interest rate.

MER: 0.09%

iShares Canadian Real Return Bond Index ETF (XRB)

Real Return Bonds

Tracks Canadian government real return bonds. They provide a hedge against inflation as their rate of return is adjusted for inflation.

MER: 0.39%

iShares Core S&P/TSX Capped Composite Index ETF (XIC)

Canadian Equities

Provides broad exposure to the Canadian equity market by covering large, mid, and small companies across all sectors. Equities are more volatile than bonds and can provide a higher rate of return. Their primary purpose is capital growth and income from dividends.

MER: 0.05%

iShares Core S&P 500 Index ETF (CAD-Hedged) (XSP)

U.S. Equities

Tracks the 500 largest publicly listed companies in the United States. Diversifying outside of Canada can provide higher returns and reduce the portfolio’s overall risk.

MER: 0.10%

Global Equities

Provides broad exposure to developed equity markets in Europe, Australia, and the Far East by covering large, mid, and small companies across all sectors. International equities provide an opportunity for growth and greater diversification.

MER: 0.08%

Real Estate

Real estate investment trusts (REITs) own a selection of office buildings, hotels, and apartment buildings. They are typically more volatile than bonds but less volatile than equities. They provide an opportunity for high income and moderate growth.

MER: 0.12%

Selecting the appropriate account structure for your investments is as crucial as choosing the investments themselves.

Asset classes

Asset classes act as the foundational building blocks of a diversified portfolio. Your asset class allocation is determined by your risk tolerance, investment objectives and other personal circumstances. In general, a longer time horizon (or objective of capital growth) will yield more exposure to risk assets (such as equities and real estate) relative to shorter investment time horizons (or objectives of capital preservation).

Benefits of diversification

Maintaining portfolio diversification can help reduce risk and improve returns. At Nest Wealth, we create portfolios that are globally diversified across different sectors and economies using Nobel-prize winning principles to help you maximize risk-adjusted returns.*

Regular rebalancing

Creating your customized portfolio is only the starting point of a successful investment strategy.

Every step of the way Nest Wealth will help make sure you are working towards your financial goals. This is done in three steps:

Step 1

Nest Wealth develops your customized ideal asset allocation based on your personal risk tolerance, your objectives and your current financial situation.

Step 2

As the market moves up and down, your portfolio’s asset allocation can drift away from your target asset mix. Our technology helps us monitor these developments.

Step 3

If an asset class rises too much, Nest Wealth will sell some. The proceeds will be used to buy other assets and restore your ideal asset allocation.

The low-cost advantage

Why passive?

Overwhelming research shows that passive investing is an effective way of growing your money over the long term by helping you keep investment costs low and stay diversified. Using this as our foundation, we build your portfolio to “be the market” rather than try to “beat the market”.

Invest like a Pro

To increase their odds of success, well-known investors such as Burt Malkiel, Jack Bogle and David Swensen focus on proper diversification, systematic rebalancing, appropriate risk and reducing fees. By keeping portfolios diversified and low cost, you can minimize investment risks while maximizing rewards over the long term.

“Being the market”

Passively managed investments are referred to as “index funds” because they’re tied to an index that represents a particular market. For example – an S&P 500 ETF would provide exposure to the S&P 500 index which measures the stock performance of some of the largest American companies in the world. That’s why passively managed index funds exist. They track and mimic the movement in the index by investing in all or some of the securities held in that index. With passive investing, your money is used to buy shares in a category of companies and that category is called an index. If that category of companies collectively performs well, so will the index and you will see the direct benefits of that in your account.

If you have any doubt or you are in need of guidance, we can find answers.

*Our portfolios are constructed using Modern Portfolio Theory which was awarded the Nobel Prize for Economics in 1990 based on a a thesis developed by Harry Markowitz. Modern Portfolio Theory uses variables such as expected return, expected volatility, and correlation of asset classes to develop an optimally weighted portfolio.

Create your Portfolio now!